Legacy Fund

Vermont Lutheran Church and Cemetery was built on a scenic hilltop. It is a historic treasure, a place for worship and community activities. The beautiful Cemetery is regularly visited by families far and wide. The Legacy Fund was established to provide for the future maintenance of our Church and Cemetery and develop and maintain the Legacy Prairie & Woodland. A gift now or a commitment in your will means your support will be continued long after your death.

Time to Build a Legacy

Become a member of the Legacy Fund. Members of the Legacy Fund come from all walks of life and are united by a desire to preserve our beautiful Church and Cemetery.

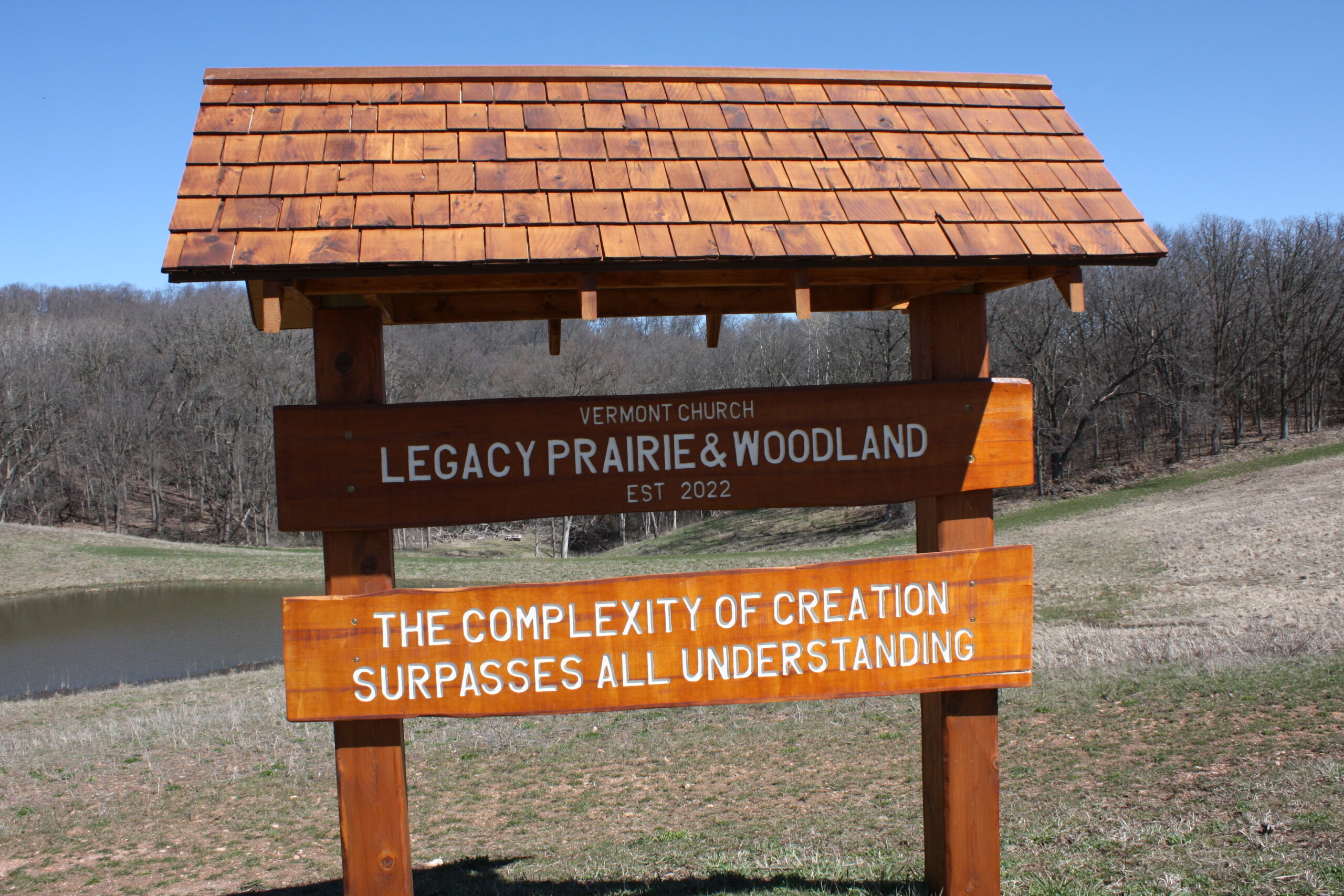

Vermont Lutheran Church owns and maintains a cemetery, historic church building and Gathering Place with a hilltop viewscape, as well as the 115 acre Legacy Prairie & Woodland. Christian stewardship involves the faithful management of all the gifts God has given us, including accumulated, inherited and appreciated resources. Therefore, we created the Legacy Fund to encourage, receive and administer these gifts.

Our goal is to generate and maintain a Legacy Fund of $1 Million dollars, or more.

Through receipt of bequests, grants and/or gifts, contributions and investment growth the Legacy Fund will serve two very important purposes now and into the future:

Any legacy member whose contribution totals $1,000 or more will be recognized with a brass plate on a prominently displayed plaque. Annual meeting reports will include all the names of those individuals who made a contribution of any amount that year.

Types of Planned Gifts

Check with your attorney that bequests are handled properly.